NBA in the UK: Challenges, Opportunities and Social Media ROI

Today, We Play released NBA in the UK: Challenges, Opportunities and Social Media ROI which is available as a free download from the company’s website WePlay.co.

The report takes an in-depth look at the NBA’s UK fan base in order to identify the opportunities and challenges the organisation faces ahead of January’s Global Game in London, which sees the Atlanta Hawks take on the Brooklyn Nets.

With tickets sold out the event could already be deemed a success, however other challenges ahead for the NBA include; reaching and engaging new audiences, sustaining conversation after the event, creating opportunities for sponsors and partners, leaving a legacy from the game and, importantly, driving revenue and ROI from social media efforts.

How do you track revenue and ROI from social media? This is the $1million question. And this report goes some way to answer that question.

We Play have monitored the growth of all 30 NBA teams social media presences for a number of months, and this analysis coupled with the company’s deep understanding of sports fan behaviour has allowed We Play to develop their Fan Evolution model, which documents the basketball fan journey from casual to avid – or, on a commercial level, from passive bystander to retained customer.

Both the Hawks and Nets are no strangers to London. The Hawks took part in the NBA’s first ever preseason games in London back in 1993 with back-to-back games against the Orlando Magic.

This will be the Nets’ third game in London after playing the Miami Heat in a pre-season match in 2008 and taking part in the first regular season games in the UK with back-to-back games against the Toronto Raptors.

Though January’s event may be only one game from an 82 game season for both teams, it’s provides the franchises with a one off opportunity to extend their fan base in a new, valuable market.

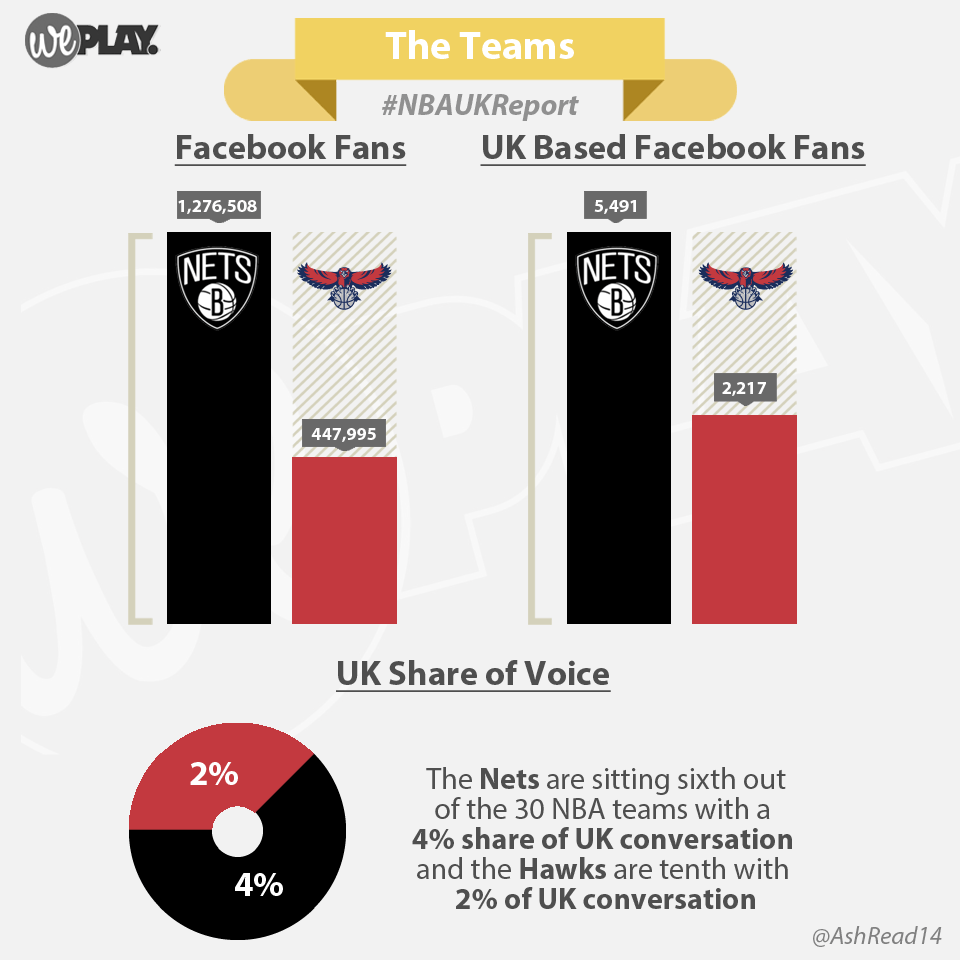

The Hawks have 447,995 fans on Facebook of which 2,217 (0.5%) are from the UK and the Nets have 1,276,508 fans on Facebook of which 5,491 (0.4%) are from the UK.

The reigning champions, Miami Heat lead the way with a 31% share of voice, the Los Angles Lakers and San Antonio Spurs sit joint second with a 10% share of voice and the Boston Celtics own 5% whilst the Knicks also sit at 4% alongside their cross-city rivals the Nets.

The NBA UK Facebook page currently has 73,416 fans, of which only 24,949 fans (34.1%) are actually from the United Kingdom. The NBA global Facebook page has 214,917 UK based fans. This highlights huge growth potential for the UK page.

NBA in the UK: Challenges, Opportunities and Social Media ROI

Included in the report:

· We Play Fan Evolution Model: how fans can go from casual bystanders to retained customers

· The challenges faced by the NBA and the teams participating in 2014 Global Games

· The impact previous NBA UK events have had on social media and lessons from these events

· Which NBA teams are currently the most talked about in the UK

· The importance of leaving a legacy from the Global Games

· How social media can help the NBA drive revenue

The report is available for FREE from the We Play website http://weplay.co/nba-

About author

You might also like

SPORTEL 2021: Day One Recap

This year’s prestigious SPORTEL convention kicked off in sunny Monaco today, welcoming a host of familiar faces as well as plenty of new ones. Doors opened at 8:30am with businesses

Six Founding Riders Set To Bring The Vision Of The UCI Track Champions League To Life

Olympic Champions, UCI World Champions and World Record holders join the new track cycling competition debuting in November 2021 The UCI Track Champions League is delighted to announce that six

Sports related spending to soar this summer as pre-pandemic life resumes

New insights from eBay Ads UK reveal the potential for brands to engage with an excited but nervous nation as sports events get back on track As pubs and indoor